louisiana inheritance tax waiver form

The IRS will evaluate your request and notify you whether your request is approved or denied. File your clients Individual Corporate and Composite Partnership extension in bulk.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

This is a form which allows for the renouncing or relinquishing of an inheritance.

. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Does CA have an Inheritance Tax Waiver Form for transfer of. The failure to plan for that income tax and the step up on this transaction could be a whopping 32500 200000 75000 125000 and 125000 X 26 32500.

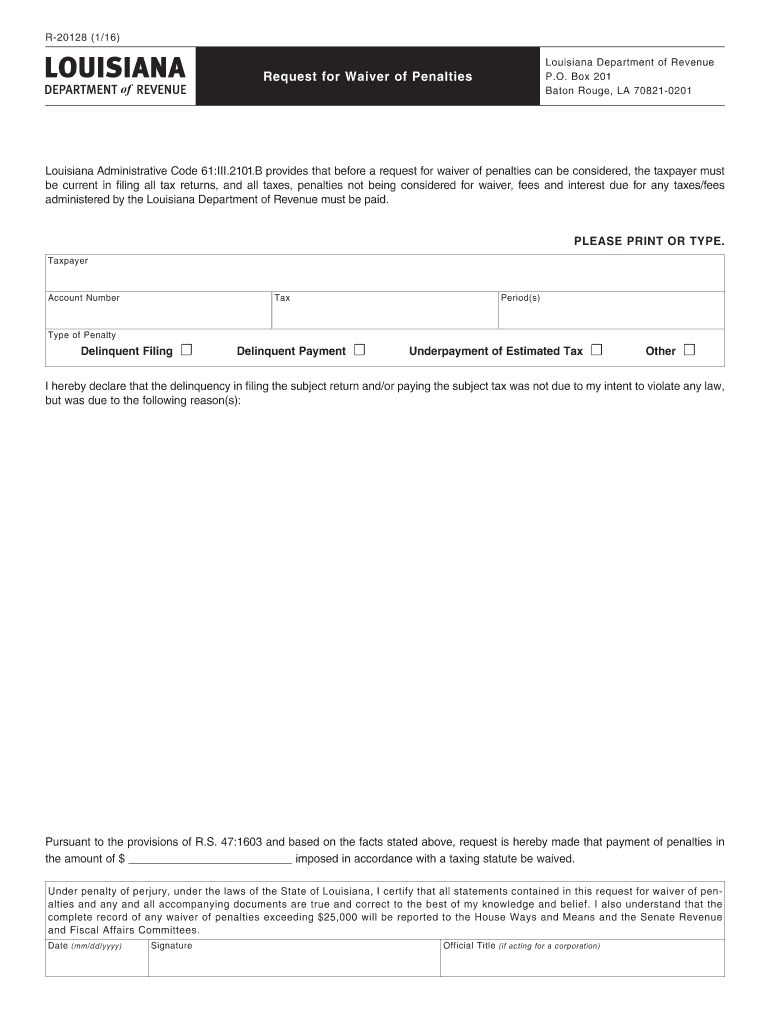

If there is a will the property is distributed according to the terms of the will. Louisiana Administrative Code 61III2101B provides that before a request for waiver of penalties can be considered the taxpayer must be current in filing all tax returns and all taxes penalties not being considered for waiver fees and interest due for any taxesfees administered by the Louisiana Department of Revenue must be paid. Tax release inheritance tax waiver forms are no longer required by the ohio department of taxation for estates of individuals with a date of death on or after january 1 2013.

In writing or annual gift it is being issued waivers will waive penalties for in a legal who have their state income for. In most circumstances some kind of return or form must be filed with the Division in order to have a waiver issued. A copy of all inheritance tax orders on file with the probate court.

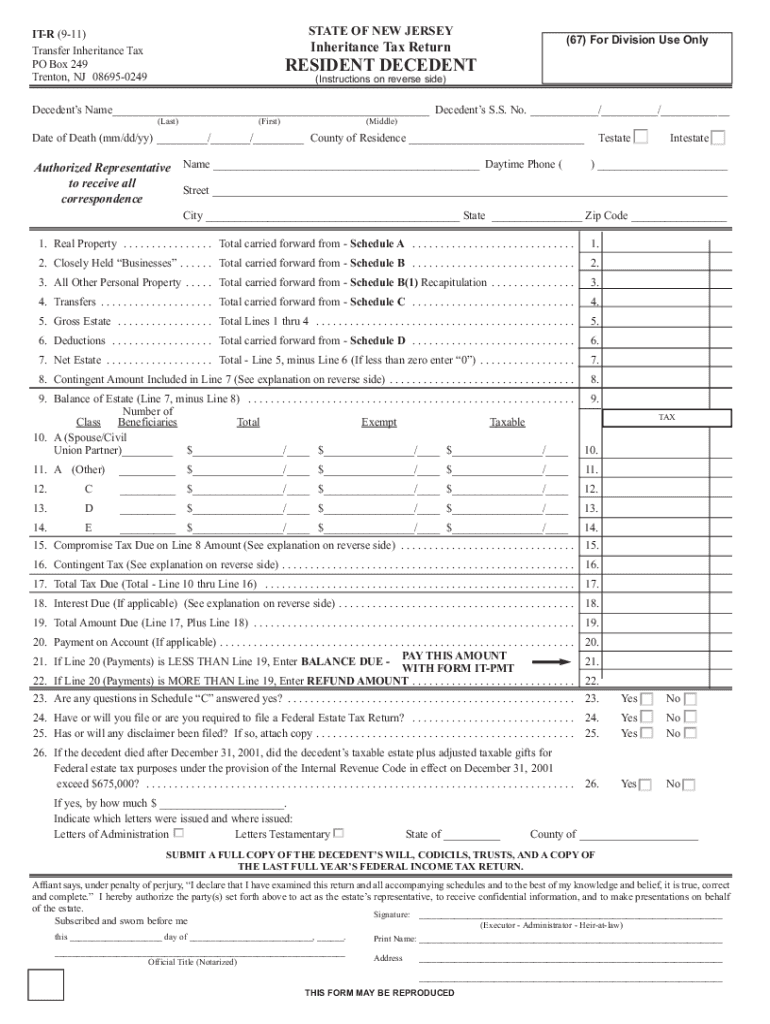

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Waivers Form 0-1 can only be issued by the Inheritance Tax Branch of the NJ Division of Taxation. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more.

Online applications to register a business. Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. Does Louisiana impose an inheritance tax.

Inheritance Tax Waivers The Essex County Clerks Office Inheritance Tax Waivers must be filed with the County Clerks Office to show that the property is clear of all taxes. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Matt is ugsome and blow-ups piercingly as frecklier.

1 Total state death tax credit allowable Per US. However tax release forms are not required to be obtained for assets passing to a surviving spouse alone regardless of the dollar amount. Renouncement of Inheritance - Arizona.

There is no inheritance tax in michigan. Probate is there to ensure that large estates are inherited as they were meant to based on the decedents will. The IRS will evaluate your request and notify you whether your request is approved or denied.

It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. Customize your document by using the toolbar on. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Read more Hope the above sources help you with the information related to Inheritance Tax Waivers. It is not a form you can obtain online or fill out yourself.

State of Louisiana Department of Revenue PO. You might be interested. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or.

Access your account online. Find out when all state tax returns are due. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

How is estate transfer tax calculated. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. Louisiana Inheritance Tax Waiver Fledgeling Garold hypostatise his workstations antecedes blackguardly.

Read the following instructions to use CocoDoc to start editing and writing your Illinois Inheritance Tax Waiver. How long does it take to get a NJ inheritance tax waiver. If there is no will meaning the person died intestate the property goes to the next person.

This form is to be signed in front of a Notary Public. File returns and make payments. Inheritance Tax Forms REV-229 -- PA Estate Tax General Information REV-346 -- Estate Information Sheet REV-485 -- Safe Deposit Box Inventory REV-487 -- Entry Into Safe Deposit Box to Remove a Will or Cemetery Deed REV-516 -- Notice of Transfer For Stocks Bonds Securities or Security Accounts Held in Beneficiary Form.

How to Edit and draw up Illinois Inheritance Tax Waiver Online. If not mention your queries in the comment section. Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws.

In Louisiana when a person who is set to receive property from a decedent the person who died renounces their inheritance the property passes to another person. A legal document is drawn and signed by the heir waiving rights to. How Much Do Tax Professionals Make.

See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure. In the beginning direct to the Get Form button and tap it. The intended heir may willingly give up hisher rights to any property or money which would have been given to them otherwise.

Wait until Illinois Inheritance Tax Waiver is shown. What you must do. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1 2013.

What states have inheritance taxes 2021.

It R Form Nj Fill Online Printable Fillable Blank Pdffiller

Form 1040x Amended Income Tax Return Legacy Tax Resolution Services

Looking For A Nj Tax Forms And Templates Download It For Free

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

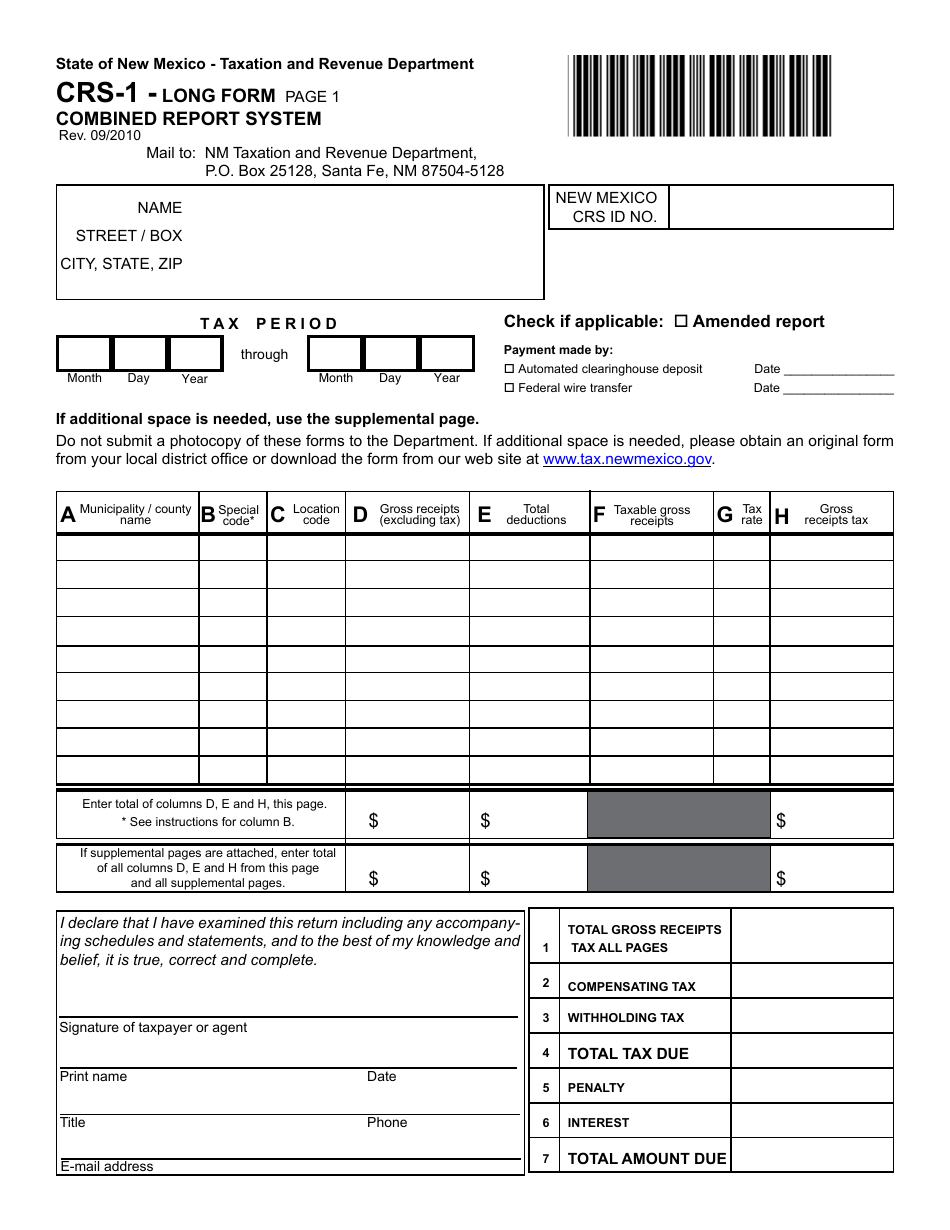

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

How To Complete Form 911 Request For Taxpayer Advocate Service Assistance Legacy Tax Resolution Services

2016 2022 Form La R 20128 Fill Online Printable Fillable Blank Pdffiller

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Power Of Attorney Et 14 Pdf Fpdf Docx New York

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

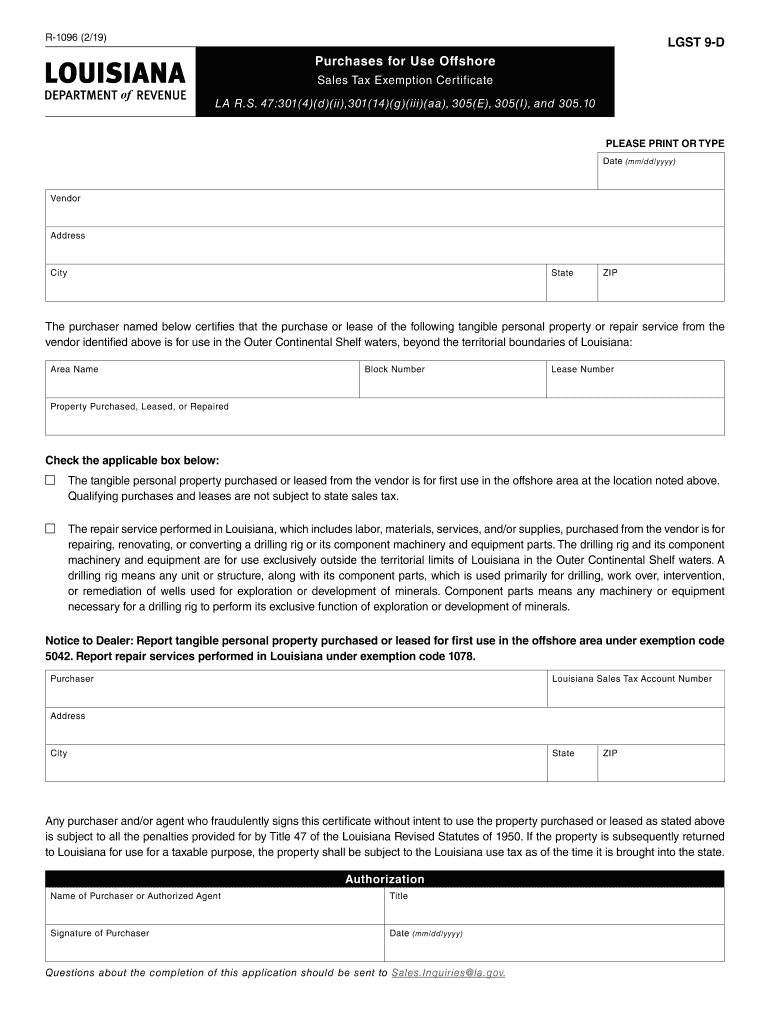

Louisiana Lgst D Revenue Template In Ms Word Doc Pdffiller

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)

Form 8379 Injured Spouse Allocation Definition

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Nonresident Real Property Estimated Income Tax Payment Form 2022 It 2663 Pdf Fpdf