cash app card balance atm

But as far as loading money at ATMs there is no such facility. Otherwise use your phone to call 800-969-1940 to check your account balance.

:max_bytes(150000):strip_icc()/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

How To Put Money On A Cash App Card

Tap on Deposit Bitcoin.

. There are two ways to activate your card. Tap the Banking tab on your Cash App home screen. Up to 1000 per 7-day period.

Tap the Pay tab and continue the transaction. Click on the Cash card icon. To add the cash to your respective Cash App card please follow the steps mentioned below in order.

Moreover the limit for the cash out is set at 1000 per dayand 310 per transaction in one day. Google Pay and Apple Pay compatibility. Here are a couple limits to keep in mind.

Locate an ATM thats affiliated with your bank your banks website will typically have a list or locator and insert the card into the indicated slot for an ATM balance inquiry. Tap the Banking tab in your Cash App. Use the options to copy your account and routing.

No you cant overdraft your Cash App Card at an ATM booth. Cash App users who have a qualifying direct deposit amount of 300 or more in their account within 31 days will be reimbursed for ATM fees for. When the menu tab pops out input the amount you want to send.

Next on the My Cash page kindly click on the option of Add Cash. Businesses that accept payments via Cash App also generate revenue for the service. A cash out transfers money from your Cash App balance to a linked bank account whereas an ATM withdrawal with the Cash Card lets you access physical cash from your Cash App balance.

While peer-to-peer payments are free Cash App makes money by offering additional services at extra cost. Insert your Cash App debit card and add your Cash Card PIN. It occasionally overdrafts the Cash App account to push the pending payment or secondary charges you have previously accepted.

A withdrawal from an ATM using your Cash App card is not the same as cashing out your Cash App balance. On the left bottom of your home screen there is an option for the My Cash tab. You can add your Cash App card to both as a payment source.

All you need is to. How to Check my Cash App Card Balance by Phone. You may withdraw 250 on Monday Wednesday Friday and Sunday for a total of 1000 in seven days.

Click Ok when Cash App requests permission to use your camera. You may withdraw up to 310 every transaction a total of 1000 in 24 hours or a total of 1000 every seven days. 1 Can Cash App be Used at an ATM.

Get Cash App here. Use Touch ID or type in your PIN. Tap the routing and account number below your balance.

The interface will prompt you to enter your PIN. Go to the Cash App on your smartphone. Cash Card ATM Withdrawal Limits.

Enter this referral code. Launch the Cash App by touching the home screen. You will receive a QR code.

Send 5 to any Cash App user to get the 5 bonus from Cash App. You will not be able to withdraw more. Heres a look at some of the features that Cash App card users can take advantage of.

All you have to do is. The Cash Card reimburses ATM fees. Tap the blue button with the arrow inside-similar to the Buy button to the right.

Go to your cash balance by tapping the My CashCash Balance or tab. Tap on the Bitcoin tab next to the Stocks tab. Tap the profile icon in the top right.

Yes you can use a Cash App card to make withdrawals at different ATMs. As long as you deposit 300 to your Cash App balance each month Cash App will reimburse the ATM fees whenever you use the card for a withdrawal. To add cash to your Cash App.

The Cash Card does support ATM cash withdrawals but there are transaction limits to keep in mind. You can also check the Cash App transaction history of up to 24 months on the website. Youll get a list of choices like deposit balance inquiry or cash withdrawal.

What is the Cash App Card ATM Withdrawal Limit. Your balance will appear on the main page or dashboard of your account much as it does with the mobile app balance tab. How It Works.

The Cash App has a debit card feature so that you can hold or withdraw directly from your bank account. Click Activate Cash Card. Log into the Cash App application.

Once you have successfully activated free ATM withdrawals each qualifying deposit you receive after that will add an additional 31 days of ATM fee. Clicktap to copy PRO TIP Invite a friend to Cash App with this code. Per transaction up to 310.

Per day up to 1000. In this post we will talk more about Cash App ATM fee withdrawal limits and if it is possible to cash out without any cost. Up to 310 per transaction.

Open the Cash App on either iPhone or Android. Here is the step-by-step process to cash out from the Cash App even without a bank account. Cash App has an automated overdraft option.

Click the -sign to display the current balance in your Cash App checking account. You may pay fees for instant transfers to your debit card bitcoin purchases and ATM withdrawals using a Cash Card linked to your Cash App. No you cant load your Cash App card at ATM.

If you get 300 or more deposited to your Cash App balance every month Cash App will reimburse ATM fees for. Note that youll incur a 2 fee as a withdrawal fee. Dial 1-855-351-2274 from your phone to get in touch with Customer Care.

Cash App can be used at any ATM. Cash App offers a variety of Boosts within the app that you can add to your card at any time. You couldnt withdraw 350 four times a week.

Cash App instantly reimburses ATM fees including ATM operator fees for customers who get 300 or more in paychecks directly deposited into their Cash App each month. The Cash App Card ATM withdrawal limits include. Here are the ATM limits for Cash Card.

Once you have correctly entered the PIN the machine will present you with options appropriate to your card and. Once you have successfully activated free ATM withdrawals each qualifying deposit you receive after that will add an additional 31 days of ATM fee reimbursements. Please click on it.

While the fee is cheaper than a regular bank ATM withdrawal there is also a Cash App Card withdrawal cash limit. Check Cash App Balance via Phone. Features of the Cash App Card.

The ATM you use may also have a withdrawal limit separate from Cash Apps settings. To add cash to your Cash App and Card you need to have a linked bank account already. At the bottom of the home screen of the Cash App you will find a icon.

The method that saves you the most thumb energy is to activate your Cash App card with a QR code. IPhone or Android 2. Add a Boost to your card and receive special offers and discounts.

Up to 1000 per 24-hour period. Tap the swirly line on the bottom right corner between the money and clock symbol. Per week up to 1000.

1 855 233 1940 The users can withdraw money from the ATMs using the Cash Card. To activate direct deposits. If you didnt set it u yet heres how to do it.

Cash App ATM withdrawals would cost you 2 fee unless you make 300 deposit in your account every month. Withdrawal limitations for Cash App ATMs are the same as they are for other ATMs.

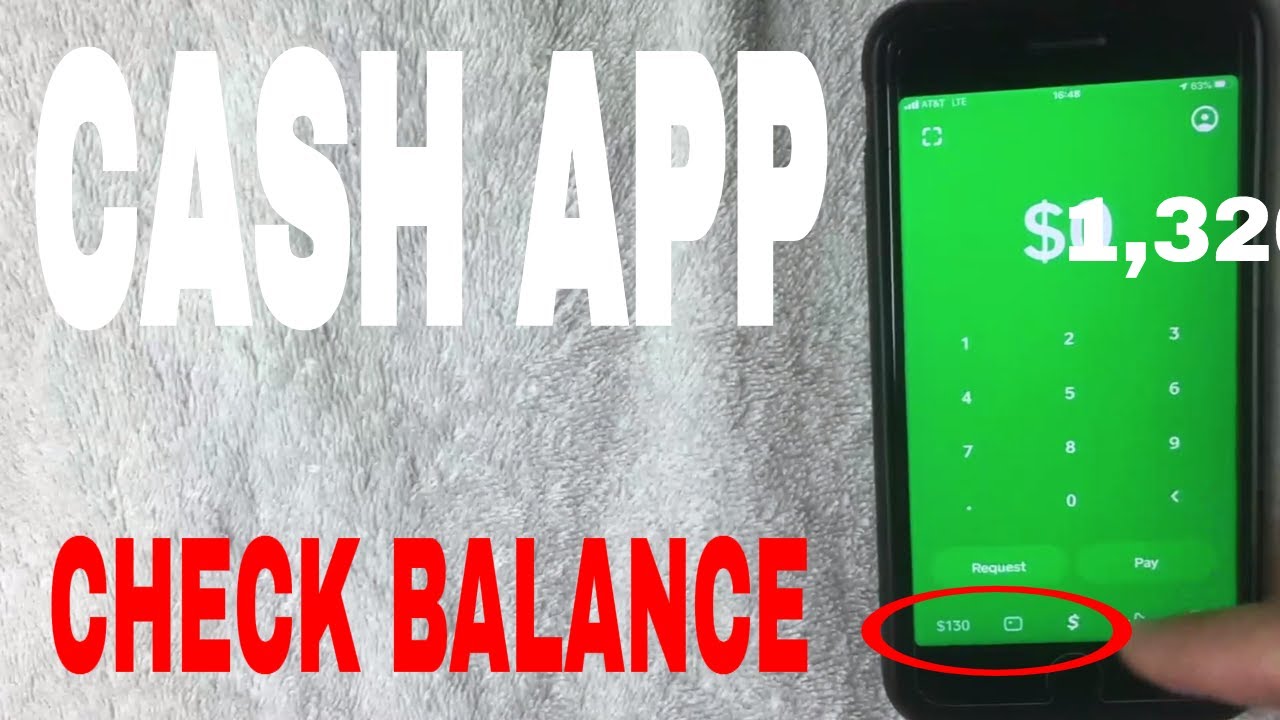

How To Check Cash App Balance Youtube

How To Check Cash App Card Balance 3 Methods Cash App Balance

How To Transfer Money From Your Cash App To Your Cash Card Visa Youtube

How To Check Cash App Card Balance 3 Methods Cash App Balance

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method

Cash App Vs Venmo How They Compare Gobankingrates

Cash App Card Number To Check Balance 2022 Cashapp Card Balance

Cash App Card Number To Check Balance

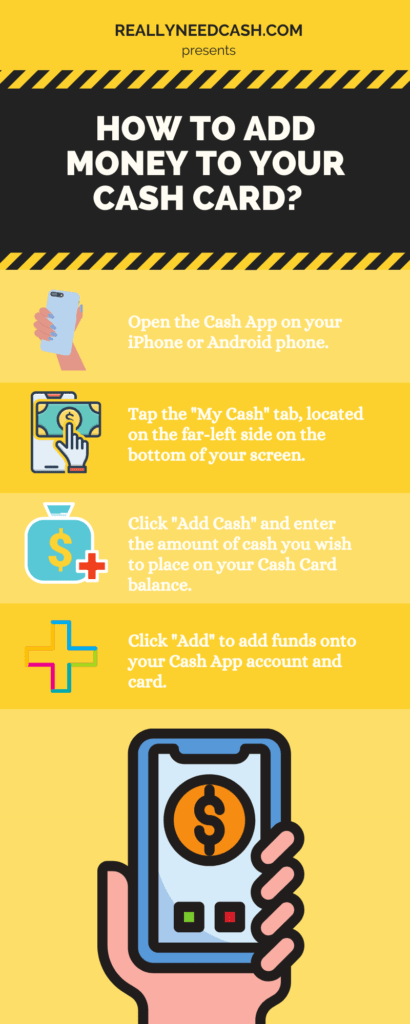

How To Add Money To Cash App Card Easy Method

How To Add Money To Your Cash App Or Cash Card

How To Check The Balance On Cash App Card Without The App By Asif Javed Issuu

How To Add Money To Cash App Card At Walgreens And Dollar General

How To Use Cash App Card At Atm Tutorial Youtube

Cash Card Review 3 Things You Should Know About Square S Cash Card Youtube

Cash App Card Features And How To Get One Gobankingrates

How To Add Money To Your Cash App Or Cash Card

Can I Check My Cash App Balance Over The Phone Online Without App

How To Add Money To Cash App Card Where Can I Reload My Cash App Card